Why China banned rare earths... but not all of them

Turns out rare earths aren't rare - but the right ones are

As I mentioned in my first post on Substack, rare earths suffer from being chemically aligned in a way that’s almost too neat. They occur together in the same deposits, turn up side by side in end-use applications, and run together through the same processing flowsheets.

While this might sound efficient, this very characteristic has led to no shortage of confusion. Anytime rare earths show up in the mainstream media, we hear “rare earths are doing this” or “rare earths are critical for that”. And while this sounds straightforward, it’s shorthand for a group of 15 to 17 different elements (depending on whether you count scandium and yttrium as rare earths) and naturally, lumping them together oversimplifies things. Their uses, their prices, their supply chains... all of it is alike but none of it is the same.

However, I’m not here to lecture you about rare earth semantics again. This time, I want to focus on something more specific and timely… I’d like to talk to you about heavy rare earths.

It’s not by chance I’m bringing this up now. If you’ve been paying attention, you’ll know that back in early April, China rolled out new export controls on a select group of seven rare earth elements (as listed below).

Samarium (Sm)

Gadolinium (Gd)

Terbium (Tb)

Dysprosium (Dy)

Lutetium (Lu)

Yttrium (Y)

Scandium (Sc)

In short, any items that contain these elements above certain threshold concentrations - whether as pure metals, oxides, compounds, or embedded in intermediate products - now fall under a new export licensing system. That means any party willing to use these items, be it traders or downstream users, must now apply for governmental approval before these items can be shipped out of China.

Frankly, it’s not the first time we’ve seen something like this. On the news of China introducing export measures, many observers were quick to recall the so-called “embargo” of 2010, when rare earth shipments to Japan were reportedly halted during a diplomatic standoff sparked by a boat collision and the detention of a Chinese fishing vessel near the Senkaku Islands. Rare earth prices soared, with some oxides increasing tenfold almost overnight, triggering panic across global supply chains. But while that episode was broad and politically charged, this time it feels more calculated.

What stands out is what’s on the list, but also what’s not on the list - notably absent are neodymium (Nd) and praseodymium (Pr), the main constituents in NdFeB magnets which underpin most of the rare earth industry's commercial value. Instead, China has turned its attention to the heavier members of the lanthanide family.

So why these specific rare earths? Why now?

To answer that, it’s important to have a closer look at the upstream rare earth value chain. Frankly, despite what headlines suggest, the rare earth bottleneck isn’t just geopolitical or about more investment in refining. It’s just about as much geological. And it seems that China, more than any other player, knows that control over the earth’s natural chokepoints leads to control over many other things down the line.

Producing rare earths

Almost everyone knows China dominates the mining of rare earths. But what far fewer appreciate is just how mine-concentrated the global supply really is. Not country-concentrated - mine concentrated. Consider this: nearly all of the world’s rare earths come from just five hard rock mines.

That’s it.

Of these five mines, three are in China (Bayan Obo, Maoniuping, Weishan), one is in the U.S. (Mountain Pass), and one can be found in Australia (Mt. Weld). See their locations marked in blue on the map below (note that the other blue dots represent smaller rare earth mines - some of which we’ll get back to later).

Together, these five operations produced around ~345,000mt of total rare earth oxides (TREO) in 2024, accounting for roughly ~85% of the global supply in 2024, based on global estimated output of ~405,000mt of TREO.

But this is exactly where the numbers start to lose meaning - if they ever made much sense to begin with. See, what TREO essentially does is that it wraps 15 distinct rare earth elements together into a single tidy headline figure (see note). It looks clean, but on its own, it tells you next to nothing.

And that’s not just a trivial point, because once you realize that TREO is just a blended headline number, the next logical step is to ask: what’s actually inside that blend? What rare earths are we talking about - and in what proportions?

In other words, it’s time to visit the topic of rare earth distributions.

Note: for clarity, note that the TREO figure typically covers only 15 out of the 17 rare earth elements. Scandium is usually excluded, as it's rarely found in the same mineral phases as the others rare earths. Promethium doesn’t show up either, since it’s radioactive with such a short half-life that it doesn’t occur in meaningful concentrations. For reference, the whole of the earth’s crust only contains 500-600 grams of promethium at a time…

On rare earth distributions

The key takeaways so far are:

Roughly 85% of global rare earth supply (on a TREO basis) comes from just five mines.

TREO figures blend all rare earths together, masking the actual composition.

Now it’s time to break that blend apart.

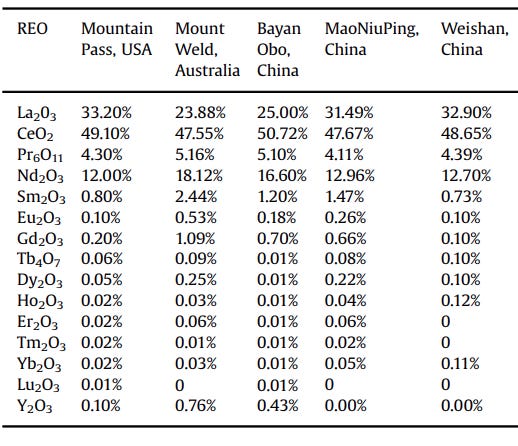

Below is the rare earth distribution across the five major mines discussed earlier. The way to interpret this is that e.g. at Mountain Pass, when you mine one unit of TREO, it will consist of 33.20% lanthanum oxide, 49.10% cerium oxide… you get the picture.

What jumps out immediately is just how lopsided these distributions are. Across all of the five mines, the bulk of the TREO figure is made up of so-called light rare earths: cerium (Ce), lanthanum (La), neodymium (Nd), praseodymium (Pr) and samarium (Sm).

Conversely, the so-called heavy rare earths - from europium (Eu) through to yttrium (Y) - barely register. That imbalance isn’t a coincidence; it’s a function of geology. All five of these deposits are associated with some form of carbonatite system, and these systems have consistently shown themselves to be rich in light rare earths and naturally short on heavies (yes, Duncan Zone, I see you… you’re the exception, not the rule).

It turns out that the ‘big five’ rare earth mines are excellent if you want to produce Ce, La or NdPr - but try squeezing out any serious volume of heavies, and you’ll quickly run into a wall. Frankly, to reach any meaningful output of heavy rare earths you’d have to increase your throughput to levels which will see your life-of-mine shrink to mere months.

An even more serious problem would the by-products you’d create when doing so. Take Mountain Pass, where for every unit of terbium you want to produce, you’re set to co-produce 818 units of cerium. Note that this is not a choice, since both elements are locked in the same mineral, and it’s only during the subsequent refining step where they separate into two streams.

I can tell you that unless you’ve secured an off-take deal with a mythical entity that consumes cerium in bottomless quantities, that by-product is going to become a liability fast…

On market balance

What we laid out in the previous paragraph isn’t just hypothetical - it’s exactly what’s playing out right now in the rare earth market. Albeit not with terbium this time, but with NdPr.

The current NdPr market is worth roughly $4.8 billion per year (~80,000 tonnes at ~$60,000/tonne NdPr oxide), which far outstrips other rare earth markets in dollar value (note that total dollar value is what really matters here, not just solely volume or price).

Combine this with NdPr being present between 16-23% in the TREO distributions of the ‘big five’ discussed earlier, and the result is that all of these operations are effectively optimized around their NdPr output.

However, for every unit of NdPr being produced at these mines, they also produce cerium and lanthanum as by-products - roughly in the ratios 2:1 and 1:1 to NdPr respectively. Like mentioned before, you can’t avoid this, since these rare earths ride together in an individual concentrate that only splits up during later refining. At that point, you might as well sell these by-products into the market to add onto your revenue base right? Sure, and that’s exactly what most of the rare earth producers do.

Except the market has heard that one before, and it usually ends the same way. Once you start pumping by-product volumes into a market that never asked for them, prices unravel.

The result is almost comical. NdPr trades for $60,000/mt, while Ce and La are trading for $1,400/mt and $500/mt respectively. Yes, steel is more expensive than the rare earth cerium. Think about that.

But to get to the gist: this is the structural flaw baked into the system. The whole rare earth machine is optimized around NdPr, with every other respective rare earth being produced in the ratio as to which it occurs relative to NdPr. That’s the reason why we’re drowning in light rare earths like cerium and lanthanum. But the heavies? They only show up in trace amounts. At current NdPr production rates, which fall in-line with NdPr demand, the geology of the big five just isn’t built to deliver heavy rare earths at scale.

This is where the story would normally end, but what if I told you that we consume far more heavy rare earths than the big five are supplying us?

On heavy rare earth supply

Consider the two heavy rare earths that get the most attention - dysprosium and terbium. The primary end-use of these two rare earths is as dopant for NdFeB magnets, where they enhance thermal stability and coercivity, allowing the magnets to maintain performance at higher temperatures and in more demanding operating conditions than they normally would.

Heavy rare earth data isn’t exactly abundant, but the best estimates we have suggest that around 3,000 tonnes of dysprosium and terbium were mined globally in 2024 - 2,500 tonnes of Dy, 500 tonnes of Tb. That’s our ballpark.

And here’s where things start to get interesting.

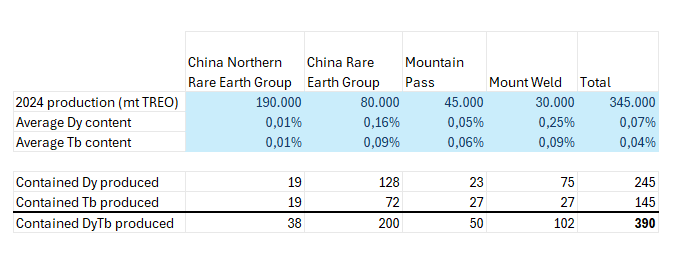

We know that global rare earth oxide (TREO) production hit about 405,000mt in 2024. And we also know that 3,000mt of that was DyTb. That would imply that DyTb accounts for roughly 0.74% of total TREO output - 3,000mt divided by 405,000mt. So far, so good.

But then we look at the big five mines - the ones that supply 85% of that TREO - things don’t quite line up. The weighted average DyTb content across those five is only about 0.11%, which translates to roughly 390mt of contained DyTb per year. This is of course only a rough estimate - but it illustrates the point clearly.

The 390mt DyTb the big five could theoretically supply is nowhere near the 3,000mt of DyTb the world actually uses. And here’s where the math gets interesting. That remaining 15% of global TREO supply - about 60,000mt - is somehow accounting for 2,510mt of DyTb. Which means that tiny slice of output is averaging a DyTb grade of 4.2%.

And if that number feels high… that’s because it is.

To figure out what’s going on, we need to take a closer look at that leftover 15% of global TREO production.

Where heavies come from

I started this article by pointing out how concentrated global rare earth supply is - just five mines are responsible for 85% of global TREO production. And that’s still true. But the reason for laying that out upfront wasn’t just to talk about the concentration of volume - it was primarily to highlight composition.

Too many in the rare earth world - media, investors, even analysts sometimes - keep falling into the same trap: obsessing over tonnage while ignoring what’s actually in the tonnage. TREO makes for a neat headline, but it tells you nothing about what the market actually needs. And as we’ve seen, when it comes to heavy rare earths like Dy and Tb, the big five can only supply a fraction of what the market demands.

Strangely enough, most of the heavy rare earth come from the margins - from a handful of obscure, low-grade sources. They are called… ionic clays.

These deposits share a tiny production of the global rare earth production pie chart - about 10% - but they’ve become the backbone of the heavy rare earth supply chain.

I think many are at least somewhat familiar with these ionic adsorption clays (IAC). I will take time in a future Substack article to discuss these clays in more detail, but for now it’s worth noting that they’re very different from the carbonatite giants we’ve been talking about so far. Found mainly in sub-tropical regions (think Southern China, Myanmar, Laos, Brazil etc.), these clays are formed by deep tropical weathering of rare earth-bearing host rock, leaving behind a clay profile enriched with rare earth elements.

What sets these clays apart from other rare earth deposits is that a proportion of the rare earths here are loosely bound to the surface of these clays, only held together by weak electrostatic force. Add a leaching agent like ammonium sulfate (NH₄)₂SO₄, and the rare earth ions in the clay quickly swap places with the ammonium. The result is a solution rich in rare earths, which can then be collected.

The way this is mostly done nowadays is via a process called ‘in-situ leaching’ which means that the leaching agent is injected directly into the ground, without physically removing any of the clay ore. Instead of blasting rock and trucking it to a mill, operators drill shallow boreholes into the clay, pump in a weak ammonium sulfate solution, and let gravity and chemistry do the rest. The solution percolates through the clay layers, stripping out the rare earth ions as it moves. Then, through a network of adjacent recovery tunnels, the now rare earth-rich solution is collected at the surface, where the rare earth solution is processed further.

But why go through this hassle - why bother with low-grade clays, tedious chemistry, and recovery wells tucked into jungle hillsides?

Simple. Again, it’s all about distribution.

Unlike the big five hard rock mines, which are heavily skewed toward light rare earths, ionic clay deposits offer something far more compelling: a natural enrichment in heavy rare earths. Thanks to a combination of several geological processes (think cerium depletion, selective adsorption of heavies - I’ll unpack this another time) these clays end up with a distribution profile quite different from their hard rock counterparts.

These deposits may be low in overall TREO content (typically between 0.05% - 0.3%), but what little they have is disproportionately rich in the good stuff: samarium, gadolinium, dysprosium, terbium, holmium, erbium, ytterbium, lutetium, and yttrium.

Below is again the rare earth distribution across the ‘big five’ hard rock producers, but this time set against the typical composition of ionic adsorption clays (IAC) in Southern China. Just scan the table and see the difference.

Note that while the above table lists the typical composition, in practice the composition of these clays can vary quite significantly per region (see the table below). Some of these clays contain up to 5% DyTb, while others contain only trace amounts. Worthy of a special mention here are the clays in Longnan, which have since long been mined out, but were exceptionally rich in heavy rare earths - with contents of up to 65% yttrium, 6.7% dysprosium, and 1.3% terbium. One can easily imagine the heavy riches these must have brought forward…

But this is the real reason these clays matter: they deliver the best heavy rare earth output per unit of NdPr anywhere in the world. And that’s the metric that counts. Because these are still NdPr mines at heart, just with far better co-production.

While the big five give you one unit of DyTb for every 200 units of NdPr, most ionic clays manage that at closer to 1:5.

This distribution efficiency is what makes ionic clays so indispensable. Currently, they are the only deposits that allow the rare earth industry to scale heavy rare earth supply in lockstep with NdPr.

The clay conundrum

And yet, despite their outsized role in supplying heavy rare earths, the supply of ionic clays is more precarious than it appears.

China’s domestic ionic clay deposits have long underpinned the global supply of heavy rare earths. But those days are fading. After decades of exploitation - legal, illegal, and everything in between - many of the richest clay deposits in Southern China have been depleted or shuttered under tightening environmental scrutiny. The result is that even China, the undisputed heavyweight of rare earths, was starting to run short on heavies.

In response, China has increasingly turned to sourcing from abroad. But this has been anything but straightforward.

Starting around 2018, Chinese producers began turning to Myanmar for supply, sourcing ionic clay concentrates from sprawling in-situ leaching operations across the Kachin State in Myanmar. These sites - run by Chinese operators under the protection of local militias - send thousands of tonnes of ionic clay concentrate across the Yunnan border each year to feed the downstream Chinese industry, primarily under China Rare Earth Group.

Figure: trucks carrying ionic clay concentrate through the Pangwa-Tengchong crossing on the Myanmar-China border

But that system is now under serious strain. Armed conflict, border closures, and a temporary export ban in 2024 have revealed just how precarious this supply line really is. And while China is already moving to diversify - investing in new ionic clay production in Laos, Malaysia, and even Brazil (about which the NY wrote this article), none of these alternatives can immediately replicate the scale that Myanmar provided.

This brings us back to the present.

Concluding remarks

This is the part where most stories about rare earths would wrap with a generic call for more investment, more exploration, or more “critical minerals strategies.” But none of that gets at the heart of the issue. Because the real problem isn’t that we lack rare earths - it’s that we lack the right rare earths in the right geological packages.

The world isn’t short on cerium or lanthanum. It’s not even short on neodymium, at least not yet. What it’s missing is a scalable, secure, and sustainable supply of heavy rare earths like dysprosium and terbium - elements that are critical to a range of advanced technologies - not least high-performance magnets - but occur only in trace concentrations in the dominant hard rock deposits that make up the bulk of TREO supply.

This is why the ionic clays matter. They’re a structural counterweight to the imbalance created by the the big five. They allow the rare earth industry to scale the output of samarium (Sm), gadolinium (Gd), terbium (Tb), dysprosium (Dy), lutetium (Lu), and yttrium (Y) in a way that no carbonatite ever could. Now, while some of these elements command higher prices than others, the real issue is the vulnerability built into their supply chain. And China knows this.

That’s why the new export controls don’t target NdPr. They target the aforementioned heavy rare earths - because those are the ones with real geological scarcity. And now that Myanmar’s supply line has proven how fragile it is, the timing starts to look intentional.

With this in mind, China’s latest export controls begin to make a lot more sense. As seen previously with antimony and other metals, dual-use regulation is the official framing, but this also appears to be a calculated move to ensure that domestic downstream industries - magnet producers, EV manufacturers, defense contractors - aren’t left short in a market where heavy rare earth supply is both limited and under pressure. In that light, the move is as much about industrial policy as it is about playing tit for tat with the Trump administration.

And here lies the uncomfortable truth for the rest of the world: if you want to build a rare earth industry that can actually compete, it’s not enough to copy what China did with NdPr. You need to go where the heavies live - and for a part, that means developing ionic clays. It means dealing with messy permitting, environmental risks, and all the local politics that come with it.

And don’t just take my word for it - look at Lynas, the largest rare earth producer outside China, which made the first move in this direction just last week.

Because without that, you can build all the magnet factories you want. But they’ll just sit there - waiting for a truck that might never come.

Absolutely brilliant insight and explanation. I can sense the next report…which clay assets!!! In seriousness, please keep writing. Thank you

Awesome read. Looking forward to a piece on BRE!